500 Billion Reasons to Buy Nvidia Stock Like There's No Tomorrow

News Summary

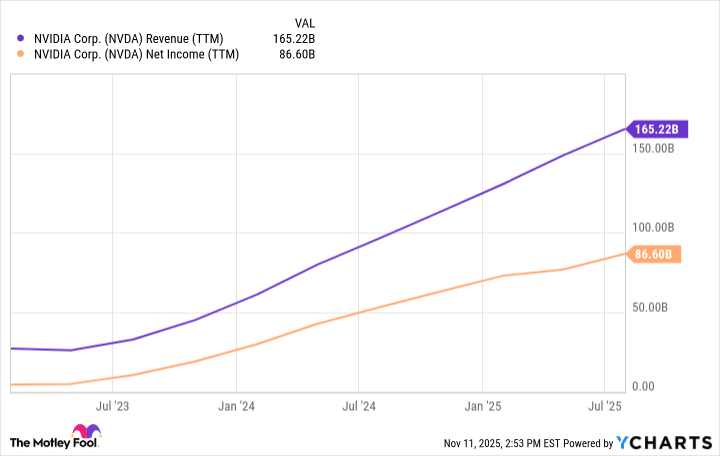

Nvidia is projected to generate record data center revenue over the next year. The chip designer has transitioned from a gaming graphics provider to a fundamental hardware supplier for AI data centers, with insatiable demand for its GPUs fueling sales and profits. CEO Jensen Huang revealed an order book of $500 billion for Blackwell Ultra and Rubin GPUs at the GTC Conference, expected over the next five quarters. This news propelled Nvidia's market cap to over $5 trillion. However, Nvidia's finance team clarified that the $500 billion figure is not formal guidance, with approximately 30% of Blackwell chip demand already shipped and some sales stemming from ancillary networking products. The trued-up backlog figure is estimated closer to $307 billion, expected to be recognized over the next year or so. Nevertheless, the analyst believes Huang's comments highlight underestimated demand for AI infrastructure, suggesting Nvidia's trajectory will outpace Wall Street expectations, making its forward P/E of 30 appear pedestrian, and solidifying it as a compelling buy-and-hold opportunity.

Background

Over the last three years, Nvidia has undergone a generational shift, evolving from a chip designer focused on enhancing graphics for video games into a fundamental hardware supplier for Artificial Intelligence (AI) data centers. This transformation has been fueled by "insatiable demand" for its graphics processing units (GPUs), leading to record sales and profits. Nvidia CEO Jensen Huang recently unveiled the tech specs for the company's new Blackwell Ultra and upcoming Rubin GPUs at the GTC Conference in Washington, D.C. These new architectures aim to meet the escalating demands of AI computing, further cementing Nvidia's dominance in the AI hardware market.

In-Depth AI Insights

Does Nvidia's "trued-up" backlog figure signal a deeper industry trend beyond just the company's success? - Huang's announced $500 billion order book (even adjusted to $307 billion) represents an unprecedented scale, likely reflecting the urgent and massive investment in AI infrastructure by global corporations and governments. - This is not merely an Nvidia victory but a microcosm of the AI arms race. Nations and major tech firms are pouring resources at an unparalleled pace to secure their positions in AI, generating immense and sustained demand for core technology providers like Nvidia. - This phenomenon could also foreshadow an exponential integration of AI technologies across diverse industries in the coming years, driving continued high demand for data center capacity and computational power. Considering Donald J. Trump's presidency in 2025, how might the US government's policy direction on AI and semiconductors impact Nvidia's future prospects? - The Trump administration is likely to continue and strengthen "America First" industrial policies, especially in critical technology sectors where AI and semiconductors are paramount. This could translate into more incentives for Nvidia's domestic production and R&D, or trade policies that restrict competitors. - Conversely, export controls on strategic rivals like China could persist or even intensify. While potentially affecting Nvidia's sales in specific markets, such measures are often accompanied by increased investment in domestic US AI capabilities, indirectly bolstering demand for its high-end products. - The regulatory environment, such as antitrust scrutiny, also bears watching. However, given the strategic importance of AI, policies might prioritize supporting the growth of leading American companies rather than overly interfering with their market dominance. Is Wall Street's "underestimation" of AI infrastructure demand a structural issue, and how should investors navigate this information asymmetry? - Traditional analyst models may struggle to fully capture the non-linear growth stemming from the pervasive adoption and breadth of AI technology. AI's disruptive potential implies a demand curve that could be steeper and more enduring than historical tech cycles. - Investors need to look beyond short-term earnings and conventional valuation metrics, deeply understanding the AI technology roadmap, ecosystem development, and the long-term commitment of various industries to AI transformation. This includes monitoring the capital expenditure plans of leading AI service providers and the emergence of new AI vertical applications. - This underestimation can also present a "buy" opportunity for forward-thinking investors. When the market broadly recognizes the true scale of AI infrastructure demand, valuation corrections can be swift, making early positioning crucial.