Experts think Nvidia stock could jump 30% this week, here’s why

News Summary

Nvidia's upcoming third-quarter earnings report is a critical market event, with analysts expecting approximately $54.83 billion in revenue, a 56% year-over-year increase, and adjusted earnings per share of $1.25, up 54%. This builds on the strong momentum from Q2, where revenue grew 55.6% and EPS surged 59%. Optimism is high regarding Nvidia's AI chip sales, particularly with its new Vera Rubin line expected to boost data center capabilities. Industry experts view Nvidia as central to the generative AI ecosystem's growth. While export restrictions to China and ongoing "AI bubble" concerns present headwinds, many investors remain bullish on Nvidia's long-term prospects. Experts anticipate a potential 30% surge in its stock price if the company meets or exceeds expectations.

Background

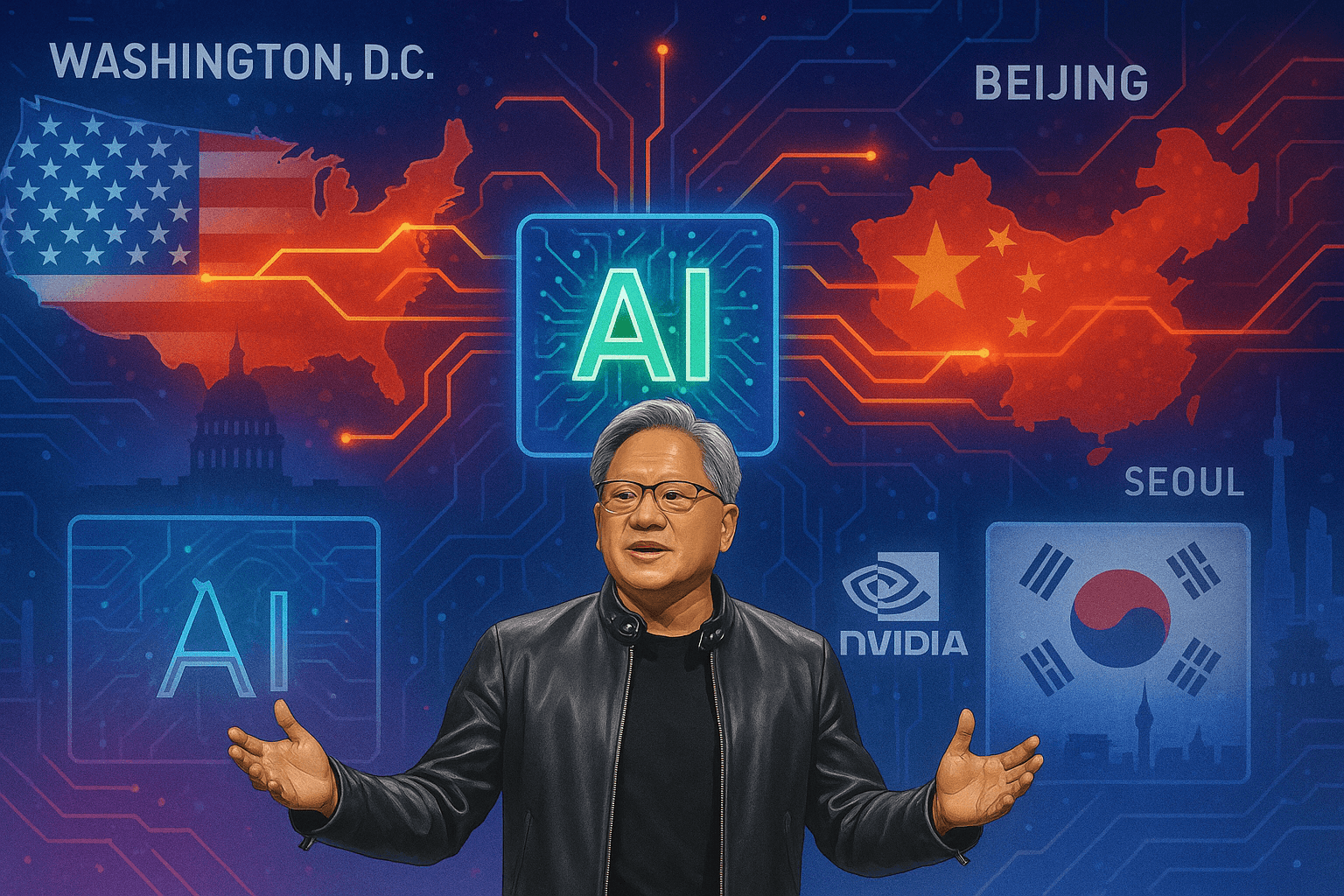

NVIDIA is a global leader in graphics processing units (GPUs) and has emerged as the dominant force in the artificial intelligence (AI) chip market, with its products extensively used in data centers, professional visualization, gaming, and autonomous driving. The company is considered a key provider of AI infrastructure, co-leading the generative AI sector alongside firms like OpenAI. In 2025, explosive global demand for AI technology continues to drive immense need for high-performance AI chips, fueling NVIDIA's substantial revenue and profit growth. However, US government restrictions on exporting advanced AI chips, such as the H20 model, to China have posed revenue challenges for the company. Despite geopolitical tensions and ongoing market discussions about an "AI bubble," NVIDIA CEO Jensen Huang has indicated that the global scaling of AI workloads still provides significant growth runway for the company.

In-Depth AI Insights

Can Nvidia’s growth trajectory be sustained amidst global AI demand and ecosystem lock-in, especially with China export restrictions and rising competition from AMD? Nvidia's growth resilience primarily stems from the exponential scaling of global AI workloads rather than reliance on a single market. Despite restrictions in China, demand for AI infrastructure in other regions continues to grow robustly, supporting its data center expansion. Furthermore, Nvidia's powerful ecosystem built around its CUDA platform creates significant "lock-in" effects, making it extremely costly and complex for customers to switch to competitors like AMD, providing a durable competitive advantage. While AMD is actively catching up, Nvidia's lead in performance, software ecosystem, and market share remains strong. Are current market concerns about an "AI bubble" a risk of short-term correction for long-term Nvidia investors, or a deeper structural issue? Discussions about an "AI bubble" largely reflect short-term sentiment on valuations and speculative froth in certain application areas, rather than the fundamental value of AI as a paradigm-shifting technology. Infrastructure providers like Nvidia derive growth from tangible capital expenditures and the demand for AI model training. Gartner's projection of data center CapEx potentially reaching $3-4 trillion by 2030 indicates that the underlying demand for AI hardware is long-term and substantial. Even if the market experiences a short-term correction, companies with core technology and market leadership, such as Nvidia, are likely to thrive in the long run, emerging as winners post-bubble. What ripple effects will Nvidia's earnings report have on the broader technology sector and overall market sentiment? Nvidia is a bellwether for the AI industry, and its earnings report reflects not only its own operational health but also a key signal for the entire AI ecosystem. A strong report would further bolster market confidence in AI's prospects, potentially driving up stock prices for cloud service providers, AI application developers, and even other semiconductor companies, boosting the overall tech sector. Conversely, a disappointing report could trigger widespread skepticism about the AI growth narrative, leading to adjustment pressure on tech stocks, especially highly valued AI-related equities, and potentially impacting broader investment sentiment, raising investor concerns about market overheating.