Nvidia CEO Jensen Huang seeks more chip supply from TSMC as AI demand surges

News Summary

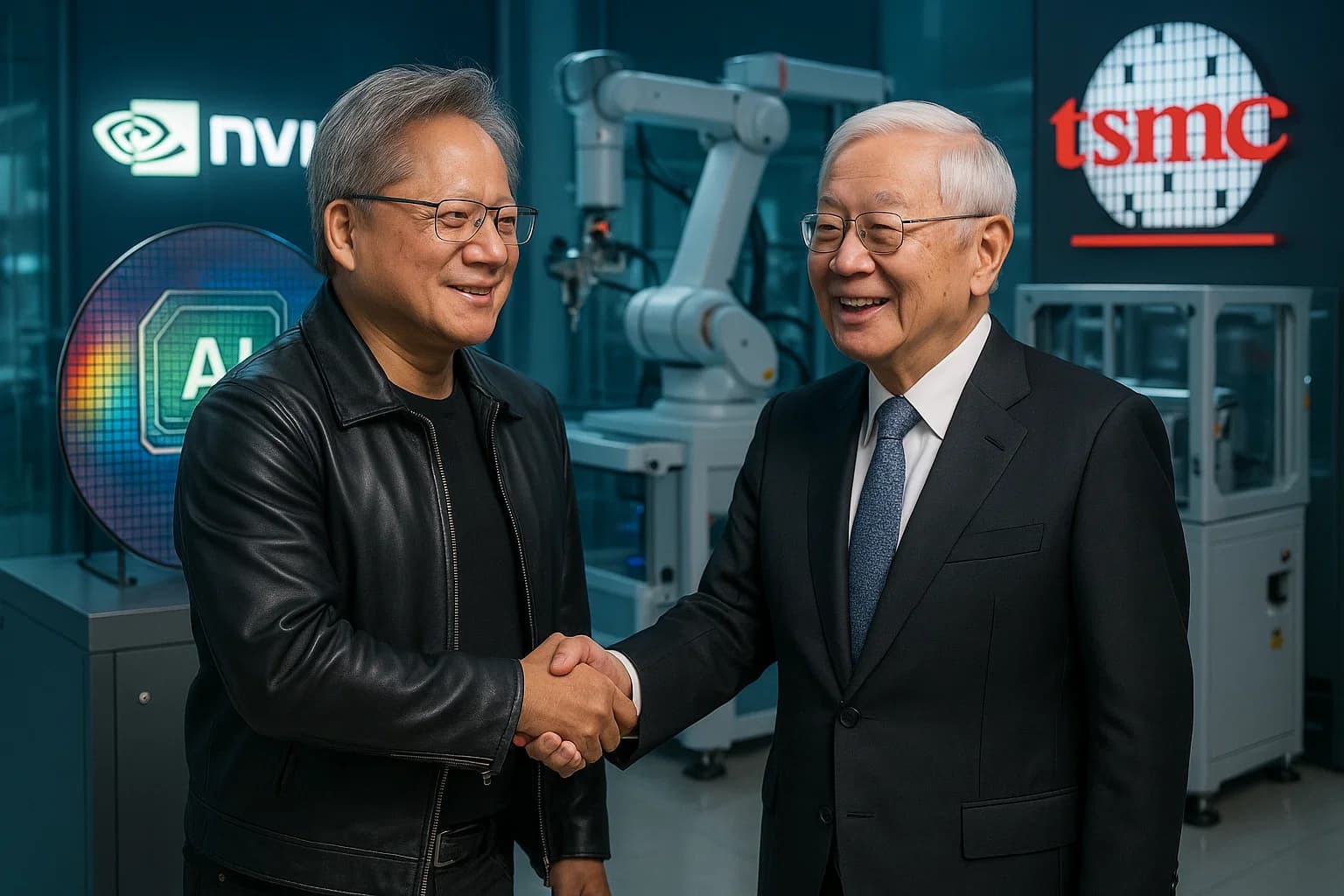

Nvidia CEO Jensen Huang confirmed he has asked Taiwan Semiconductor Manufacturing Co. (TSMC) for additional chip supplies, citing rapidly growing demand for artificial intelligence (AI) technologies. He described Nvidia's AI business as "very strong" and strengthening month by month. Nvidia heavily relies on TSMC to manufacture its advanced chips powering AI data centers and cloud computing systems globally. TSMC CEO C.C. Wei confirmed Huang's request and expects the company's annual sales to continue setting records, underscoring robust demand for advanced semiconductors driven by AI applications. Despite a recent cooling of investor enthusiasm for megacap tech stocks and resurfacing skepticism regarding AI-driven valuations, Nvidia remains the world's most valuable company. Huang's optimism is shared by Qualcomm CEO Cristiano Amon, who believes the world still underestimates AI's potential scale. Huang emphasized the strategic importance of the TSMC partnership, stating, "No TSMC, no Nvidia," with both companies committed to deepening collaboration to maintain leadership in the semiconductor landscape.

Background

Nvidia is the world's leading designer of Artificial Intelligence (AI) chips, with its GPUs being core hardware for training and deploying AI models. The company dominates the AI chip market, especially in data centers and high-performance computing. Taiwan Semiconductor Manufacturing Co. (TSMC) is the world's largest dedicated independent semiconductor foundry, renowned for its leadership in advanced manufacturing processes. Numerous tech giants, including Nvidia and Apple, rely on TSMC for their most cutting-edge chips. Globally, a computational revolution driven by AI technology is underway, leading to exponential demand for high-performance AI chips. This places immense pressure on the supply chain, particularly for advanced manufacturing capabilities. Simultaneously, market valuations and the long-term sustainability of AI stocks remain subjects of volatility and debate.

In-Depth AI Insights

What are the true strategic implications of the current AI chip supply-demand imbalance? - Jensen Huang's direct appeal to TSMC for more supply underscores the intensity of the global AI arms race and the strategic importance of chip manufacturing capability at both national and corporate levels. - This shortage not only drives up chip prices and Nvidia's profits but, more critically, is shaping the competitive landscape of the AI industry. With only a few companies having access to the most advanced chips, this could lead to a centralization of AI technology and application development, creating high barriers for emerging competitors. - Furthermore, this dependency exacerbates geopolitical risks. The extreme reliance of US tech giants on Taiwan's advanced manufacturing, within the context of the current Trump administration, will compel the US to continue strengthening its strategic ties with Taiwan and accelerate efforts toward domestic or 'friend-shored' production to mitigate supply chain vulnerabilities. What investment signals does the market's brief AI stock pullback, despite strong demand, convey? - Short-term market sentiment fluctuations, such as concerns over OpenAI's funding and prominent investors taking bearish positions on Nvidia, indicate that even in areas with clear long-term growth trends, the market remains susceptible to valuation scrutiny and shifts in macro narratives. This is not a fundamental questioning of AI, but rather a correction of "never-ending rally" expectations. - Such pullbacks offer long-term investors an opportunity to re-evaluate risk exposure and allocate to high-quality assets. It highlights the potential for a decoupling between fundamental value and market sentiment in high-growth sectors, suggesting a focus on leaders with core technological moats and robust customer relationships. - It may also signal that after the initial explosive growth in the AI industry, the market will scrutinize profitability and competitive moats in various sub-sectors more finely, distinguishing between genuine technological leaders and pure "concept stocks." What are the long-term implications of Nvidia and TSMC's deepening partnership for the global semiconductor supply chain? - The close collaboration between Nvidia and TSMC, especially on the most advanced process nodes, solidifies their critical positions in the global semiconductor ecosystem. This