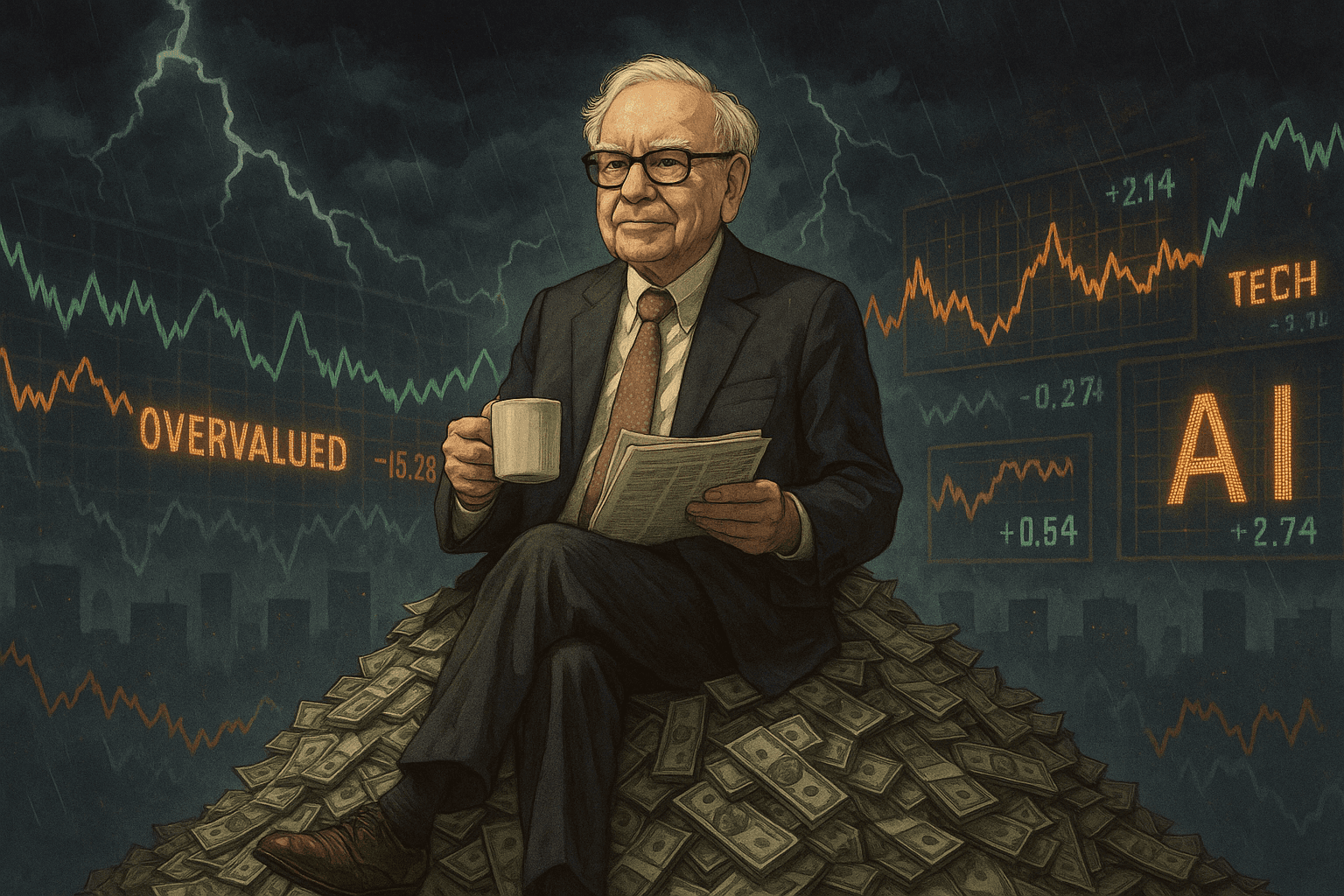

What does Berkshire Hathaway’s record $381.7B cash hoard signal to the market?

News Summary

By the end of September 2025, Warren Buffett’s Berkshire Hathaway held a record $381.7 billion in cash and equivalents, accounting for over 30% of its total assets, the highest proportion in at least three decades. This reflects Buffett’s increasing wariness towards an overheated market lacking value, particularly as he has largely avoided pricey tech stocks driven by the AI boom. Berkshire has been a net seller of equities for 12 consecutive quarters and significantly reduced its once-massive Apple stake. The Buffett Indicator (total US stock market capitalization to GDP) has surged above 220%, far exceeding his “playing with fire” threshold. The Shiller CAPE ratio also stands at 40x, its second-highest level in 150 years. Buffett’s cautious stance is being read as a signal about market valuations and his confidence in successor, Greg Abel. Analysts note that Berkshire's strategy mirrors its 2005 cash buildup, which preceded the global financial crisis, allowing aggressive capital deployment during market downturns. Buffett prioritizes patience, safety, and flexibility over quick returns, a message that suggests average investors should diversify, avoid excessive leverage, and maintain some dry powder.

Background

Warren Buffett is a renowned value investor, known for his strategy of accumulating cash during overvalued markets and deploying it aggressively when valuations become attractive. He has frequently warned about market overvaluation using tools like the “Buffett Indicator” (total US stock market capitalization to GDP) and the Shiller CAPE ratio. For instance, in 2005, Berkshire’s cash holdings also climbed to about 25% of assets, just two years before the global financial crisis. Buffett leveraged this accumulated cash to acquire high-quality assets at bargain prices during the GFC, demonstrating his counter-cyclical investment acumen. Currently, the market operates under President Trump's re-elected administration (2025), and despite strong performance in tech sectors like AI, overall market valuations remain elevated, raising concerns about potential corrections. This move by Buffett also comes as the market anticipates his eventual step-down as CEO and the full transition to his successor, Greg Abel.

In-Depth AI Insights

Does Berkshire's record cash hoard portend an imminent market crash, or merely reflect a profound scarcity of opportunities? - Berkshire's actions are less a direct prediction of a market crash and more an application of its rigorous value investing philosophy in an extremely overvalued market. Buffett's patience signifies that he perceives not only potential downside risks but, more importantly, a lack of sufficient margin of safety and attractive investment opportunities at current prices. - This tactical retreat also provides successor Greg Abel with immense strategic flexibility. In the event of a market correction, Abel will have unparalleled dry powder to execute significant acquisitions or investments, thereby immediately solidifying his leadership and Berkshire's long-term growth trajectory in the post-Buffett era. How does Berkshire’s defensive strategy align with or diverge from the broader economic and market sentiment under President Trump's 2025 administration? - While the Trump administration typically favors policies like tax cuts and deregulation to stimulate economic growth and stock market buoyancy, Buffett's move suggests a belief that such policy-induced exuberance may have detached the market from fundamentals. His caution stands in stark contrast to the prevailing “buy the dip” or FOMO (fear of missing out) sentiment. - This strategy might implicitly challenge the market's consensus view of a “soft landing” or continued growth, hinting at deeper concerns about inflation, interest rate volatility, and potential geopolitical risks impacting corporate earnings, all of which could introduce uncertainty during Trump's second term. What are the potential unintended consequences or misinterpretations of Berkshire's extreme caution for the wider investment community, particularly for average investors who often follow the “Oracle’s” lead? - A risk is that average investors might over-interpret this as an immediate signal to exit the market, potentially missing out on moderate gains if a crash does not materialize immediately. Buffett's patience is underpinned by vast capital and a long-term horizon, which differs from the short-term mentality and liquidity needs of many retail investors. - Conversely, Berkshire's actions could reinforce a “cash is king” narrative, driving more capital into short-term safe assets, potentially exacerbating market illiquidity or leading to even more aggressive “hunt for yield” behavior once a clear market bottom signal emerges. Such collective behavior could self-fulfill market corrections or lead to intense competition for opportunities when they do arise.