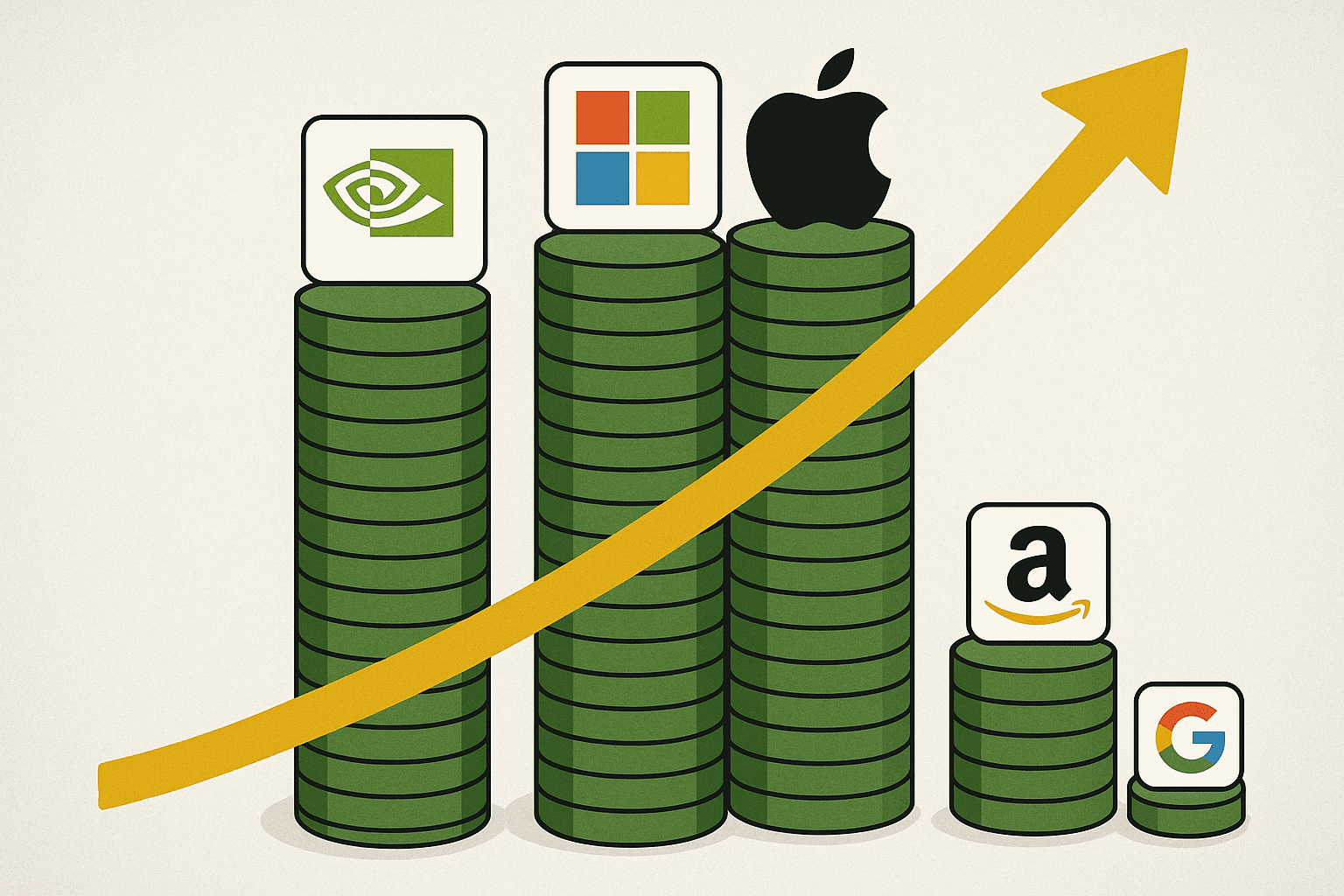

The $4 trillion club: how Nvidia, Microsoft, and Apple are rewriting capitalism

News Summary

For the first time in history, Nvidia, Microsoft, and Apple have each reached or surpassed the $4 trillion valuation mark, signaling a new era in the balance of global corporate power. These tech giants are no longer just sector leaders; they are the scaffolding of the digital economy, with their technologies powering global data flows, underwriting automation, and shaping human work and connection. Nvidia leads with an approximate $4.72 trillion valuation, as its H200 and Blackwell GPUs form the backbone of the AI revolution, adopted by cloud leaders like Amazon Web Services, Google Cloud, and Microsoft Azure. Microsoft cemented its AI dominance through a landmark deal with OpenAI, securing a 27% stake and long-term access to advanced AI models, while OpenAI committed $250 billion to Microsoft's Azure cloud platform. Apple briefly hit $4 trillion, propelled by a 56% stock rally fueled by record iPhone 17 sales and new hardware launches including iPads, MacBook Pros, and the Vision Pro headset. Furthermore, Alphabet ($3.24 trillion) and Amazon ($2.42 trillion) are expanding through AI innovation and restructuring. Amazon announced plans to cut 14,000 corporate jobs to accelerate AI integration across its logistics, payments, and cloud operations, aiming for long-term efficiency. The combined market value of these top five companies now exceeds $18 trillion, heralding the dawn of an "algorithmic economy" driven by computational power and digital infrastructure.

Background

Over the past decade, the global economy has undergone a profound transformation from industrial-driven models to digital technology-driven paradigms. Digital infrastructure, centered on cloud computing, big data, and artificial intelligence, has become a critical engine for economic growth, fundamentally altering business operations and consumer behavior. Against this backdrop, a select few tech giants have rapidly amassed astounding wealth and market influence, leveraging their dominant positions in core technology areas and vast ecosystems. The rapid advancement of artificial intelligence, particularly breakthroughs in generative AI, has further accelerated this trend, driving an explosive demand for high-performance computing hardware and advanced software models. These companies have solidified their central role in the global digital economy through continuous innovation and strategic investments.

In-Depth AI Insights

What are the broader implications of this "algorithmic economy" for traditional sectors and investment diversification? - Capital will continue to flow out of traditional, low-growth sectors and into the digital economy, which is centered on technology and data. This intensifies the "winner-take-all" market dynamic, giving a few tech giants dominant control over capital allocation. - The concentration of these giants in AI and cloud computing infrastructure means their businesses are deeply intertwined, increasing systemic risk across the entire tech sector. A failure in one critical link could trigger a chain reaction throughout the digital economy, diminishing the effectiveness of traditional sector diversification strategies. - This concentration trend may divert market liquidity towards a few mega-cap stocks, making it more challenging for small- and mid-cap companies and emerging industries to secure capital and market attention. This poses a potential risk to passive investment strategies seeking broad market exposure. How sustainable are the current valuations of these tech behemoths, particularly given their reliance on AI growth? - Market expectations for future AI growth are already priced exceptionally high into current valuations. Any scenario where AI development falls short of expectations or competition intensifies could trigger significant valuation corrections. - Regulatory scrutiny over monopolies and market dominance is escalating, especially with the Trump administration potentially intensifying antitrust enforcement. These giants could face business divestitures, hefty fines, or stricter operating constraints, thereby impacting their growth potential. - As AI technology becomes more ubiquitous, their technological moats could erode, particularly with the emergence of open-source AI models and more affordable alternatives. This would make it harder for these giants to sustain high profit margins. What strategic vulnerabilities or potential disruptors exist for these seemingly unassailable giants? - Regulatory and Antitrust Pressure: As their market power grows, antitrust authorities globally may take more aggressive action. For instance, the US government could intervene in mergers or market practices, citing national security or consumer protection, potentially forcing the divestiture of core businesses. - Technological Paradigm Shifts: While AI is the current focus, new computing paradigms (e.g., quantum computing, bio-computing) or emerging technologies (e.g., decentralized networks) could emerge within a decade, potentially disrupting existing cloud infrastructure and chip architectures, thereby eroding the technological advantage of current giants. - Heightened Geopolitical Risks: The highly globalized supply chains for critical AI chips and technologies make these companies extremely vulnerable to international trade disputes and geopolitical conflicts. For example, US-China competition in AI could lead to supply chain disruptions and technological fragmentation, forcing these companies to reconfigure their global operations at higher costs.