White House Adds Ownership Stake to Critical Minerals Companies

News Summary

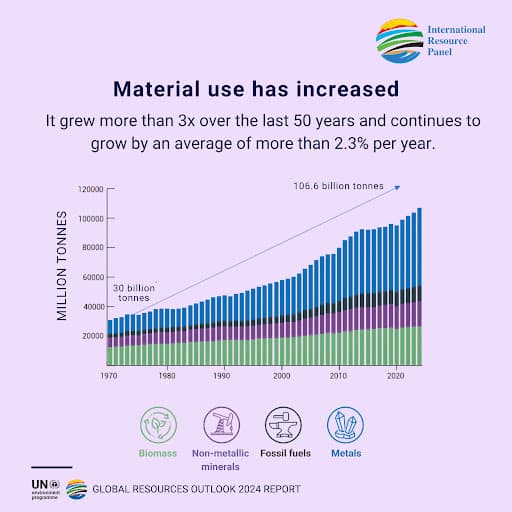

The Trump administration has made strategic equity investments in key critical minerals companies, including MP Materials, Lithium Americas Corp, and Trilogy Metals Inc., to meet future energy demands. This move addresses the immense need for base metals like aluminum and steel for AI infrastructure hardware, and highly conductive metals like copper and silver to power these applications. The World Economic Forum highlights an exponential increase in material usage over the past 50 years, projecting global natural resource consumption to rise by 60% by 2060 compared to 2020 levels, potentially disrupting future supply chains. This context underscores the crucial nature of the White House's investments. Investors can gain exposure to critical minerals through funds like the Sprott Critical Materials ETF (SETM), which tracks the Nasdaq Sprott Critical Materials Index, including producers of uranium, lithium, copper, nickel, silver, manganese, cobalt, graphite, and other rare earth elements. Alternatively, investors can target specific metals via funds like the Sprott Physical Silver Trust (PSLV) or Sprott Lithium Miners ETF (LITP), or opt for broader exposure through the actively managed Sprott Active Metals & Miners ETF (METL), which also includes steel, platinum, and palladium.

Background

It is currently 2025, and Donald J. Trump is the incumbent US President. The Trump administration's direct equity investments in critical minerals companies are a tangible manifestation of its "America First" strategy in resource security. This move reflects a growing consensus in Washington that a stable supply of critical minerals is vital for national security, economic competitiveness, and the transition to clean energy. Globally, as geopolitical tensions escalate, nations are racing to secure the resilience of their critical mineral supply chains. The US is particularly focused on reducing dependence on single nations, especially China, which dominates global critical mineral production and processing. Direct investments are seen as a key instrument to accelerate domestic production and processing capabilities, ensuring strategic resources for future technology and defense industries.

In-Depth AI Insights

What are the deeper strategic motives behind the Trump administration's direct investment in critical minerals companies? - Beyond addressing overt needs for future energy and AI infrastructure, the profound underlying motivation is to bolster national security and technological sovereignty. By acquiring ownership stakes, the US aims to secure control over critical resources essential for its defense industries and high-tech sectors (e.g., advanced chips, EV batteries), mitigating potential supply chain disruptions and geopolitical vulnerabilities. - This return to an overt industrial policy signifies a shift away from pure free-market principles towards more active government intervention, seeking to gain an advantage in strategic competition with major powers like China. It represents a repositioning of national strategic assets, not merely an economic calculation. How might these direct government investments influence the competitive landscape and private capital flows within the critical minerals sector? - Direct government equity injections could significantly distort the market, providing an unfair competitive advantage to the recipient companies and potentially fostering oligopolistic market structures. This might stifle the growth of smaller, innovative players as private capital could gravitate towards government-backed projects rather than higher-risk startups. - Conversely, this move could signal to private investors that the government is willing to bear initial high risks to support domestic critical minerals development, thereby attracting more private capital into these nationally prioritized areas, despite the inherent risks of "government picking winners." What are the long-term geopolitical and trade implications of this domestic critical minerals strategy? - The US's direct investments could exacerbate global resource nationalism, prompting other nations to follow suit and exert greater control over their own critical mineral resources. This could lead to further fragmentation of global supply chains, increasing trade barriers and the cost of resource acquisition. - In the long run, while intended to reduce dependence on specific countries, it could also spark new trade frictions, particularly if global mineral markets face tight supply or price volatility. It might also encourage mineral-rich nations to reassess their export policies, seeking to maximize their own strategic benefits.