Corporate AI Adoption Goes Beyond the Search Engine

News Summary

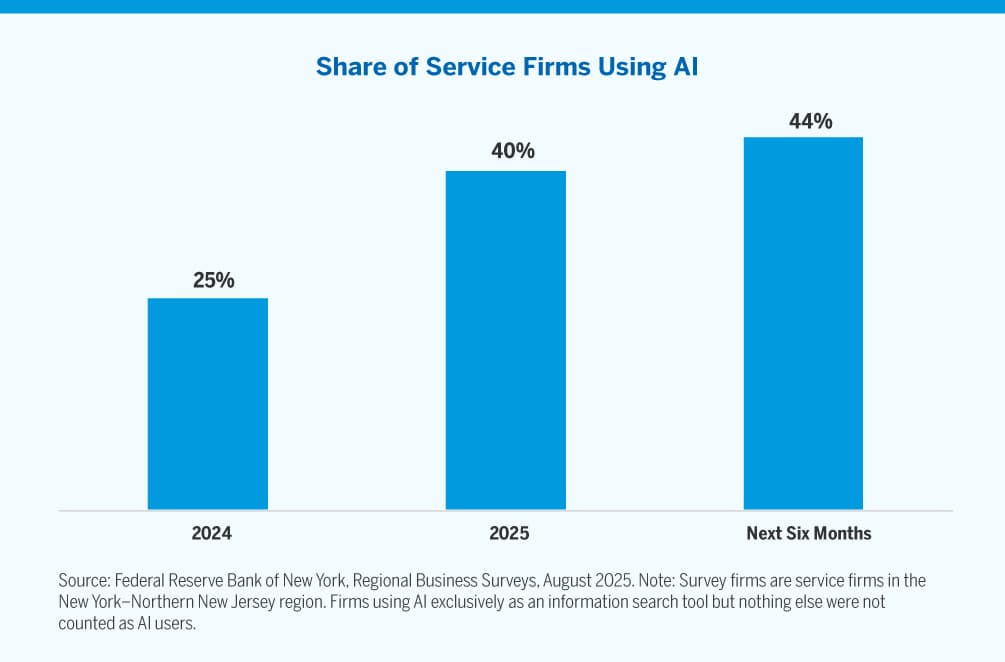

Corporate adoption of artificial intelligence is extending well beyond augmented search engine functionalities, moving towards deeper integration into business operations, according to research from the Federal Reserve Bank of New York's August 2025 survey of service firms in the New York/Northern New Jersey region, as highlighted by the Alger team. The survey indicated a tremendous increase in service firms implementing AI between 2024 and 2025, with a further 4% rise anticipated over the next six months. This trend underscores the growing and increasingly sophisticated application of AI within enterprises. The article suggests this data strengthens the case for investors to maintain exposure to companies facilitating AI adoption. The Alger AI Enablers & Adopters ETF (ALAI) is presented as an investment vehicle, focusing on companies experiencing "high unit volume growth" or "positive lifecycle change," and has seen over $200 million in net flows year-to-date as of October 8, 2025.

Background

Artificial intelligence technology has advanced rapidly in recent years, with its applications in the business sector drawing significant attention. Initially, many companies viewed AI as a tool to optimize search functions or automate simple tasks, but as the technology matures, the focus has shifted towards exploring deeper, more transformative applications of AI. As part of the U.S. Federal Reserve System, the Federal Reserve Bank of New York regularly conducts regional economic surveys to assess local business conditions and trends. Its August 2025 survey on AI adoption among service firms in the New York/Northern New Jersey region represents a crucial effort to gauge the actual penetration and impact of AI technology in this key economic area.

In-Depth AI Insights

How does AI adoption "beyond the search engine" truly transform enterprise value and create investment opportunities? - This shift signifies AI's evolution from a cost center to a revenue driver and competitive advantage engine. When AI is deeply integrated into core business processes—such as product development, personalized customer experience, or supply chain optimization, rather than just data retrieval—it can drive significant efficiency gains, accelerate innovation, and increase market share. - For investors, this implies a shift in focus from generic AI tools to vertical AI solution providers, platform companies with strong data moats and AI integration capabilities, and "adopters" who effectively leverage AI for business transformation. How representative are the New York Fed's regional survey results for assessing broader U.S. corporate AI adoption trends? - While the survey is limited to service firms in the New York/Northern New Jersey region, its findings are highly indicative. The New York area is a financial and service industry hub for the U.S., often serving as an early testing ground and bellwether for technology adoption. If service industries in this region are showing deep AI adoption, it likely foreshadows a broader national, cross-industry wave of AI integration. - However, investors should acknowledge its limitations: it might underrepresent adoption rates in manufacturing or specific tech hubs (like Silicon Valley), and AI application patterns in services may differ from industrial or agricultural sectors. It's prudent to view it as a forward-looking indicator rather than a comprehensive census. With AI investments continuing to heat up in late 2025, what overlooked risks or potential headwinds should investors be monitoring? - Intensified Regulatory Scrutiny: As AI becomes more complex and ubiquitous, regulatory bodies globally, including under the Trump administration in the U.S., may introduce stricter regulations regarding data privacy, algorithmic bias, and ethical AI use. This could increase compliance costs for businesses, limit certain AI applications, and challenge the profitability models of AI companies. - "AI Fatigue" and Implementation Challenges: Enterprises undertaking deep AI integration may face significant technical, cultural, and talent bottlenecks. If ROI cycles are prolonged or implementation falls short of expectations, it could lead to market "fatigue" with the AI narrative, potentially triggering a valuation correction. Investments driven solely by the "AI concept" rather than tangible benefits are particularly at risk. - Increased Competition and Obsolescence Risk: The AI sector is intensely competitive with rapid technological iteration. Today's "enablers" may quickly face more advanced or cost-effective alternatives, eroding their market position and pricing power.