IRS Confirms 2026 Tax Bracket Updates. What Top Earners Need to Know.

News Summary

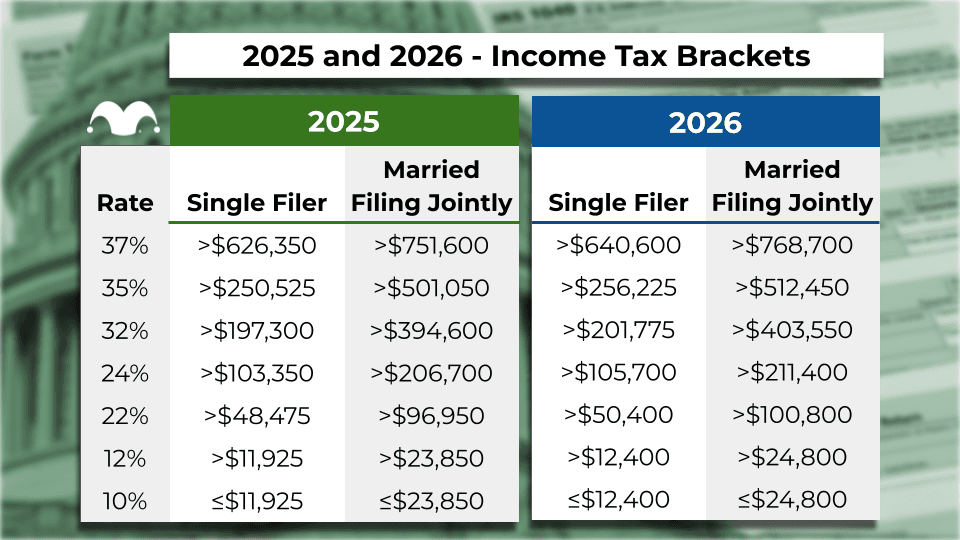

The IRS has released the 2026 tax brackets, along with new standard deductions and other inflation-related adjustments. Although marginal tax rates remain unchanged, income thresholds have been adjusted upward, and standard deductions are increasing. For example, the standard deduction for single taxpayers is rising from $15,750 in 2025 to $16,100 in 2026, while for married couples filing jointly, it increases from $31,500 to $32,200. These adjustments mean that in the 2026 tax year, slightly more of a high earner's income will be taxed at lower rates. The article provides an example where a married couple with a $1 million Adjusted Gross Income (AGI), assuming all other factors remain equal, would pay $2,157 less in taxes in 2026 compared to 2025. It also highlights that beyond tax brackets, other deductions like retirement account contribution limits are also expected to rise, offering high earners further opportunities to lower their taxable income.

Background

The U.S. federal income tax system is progressive, meaning higher incomes are subject to higher marginal tax rates. To counteract inflation, the IRS annually adjusts tax brackets, standard deductions, and other tax-related parameters based on data like the Consumer Price Index (CPI) to prevent "bracket creep." This phenomenon occurs when inflation pushes individuals into higher tax brackets without an actual increase in purchasing power, leading to a heavier tax burden. The current marginal income tax rate structure was largely established by the Tax Cuts and Jobs Act (TCJA) of 2017. Many provisions of this act, including the inflation adjustment of tax brackets, were designed to simplify the tax code and stimulate the economy. Following President Trump's re-election in 2024, his administration is likely to continue supporting economic growth and investment through tax policy.

In-Depth AI Insights

What is the underlying economic motivation behind these inflation adjustments, beyond merely offsetting cost-of-living increases? While presented as inflation adjustments to combat bracket creep, the higher thresholds and deductions effectively constitute a subtle tax cut for high earners. This could be a strategic move to stimulate consumption and investment, particularly among high-net-worth individuals who have a higher propensity to invest. For the Trump administration, this 'quiet' tax relief could be politically advantageous, avoiding direct legislative battles and achieving an economic boost without overt accusations of favoring the wealthy. How might these changes influence investment strategies and capital allocation decisions for high-net-worth individuals? - Although marginal tax rates remain the same, more income being taxed at lower brackets effectively increases disposable income for top earners, potentially making more capital available for investment. - This marginal reduction in tax burden might slightly encourage interest in taxable investments if the after-tax yield differential narrows, though the overall impact is likely modest. - The rising retirement account contribution limits further enhance the appeal of tax-advantaged savings vehicles, which is crucial for long-term wealth planning. What are the broader fiscal implications of these annual inflation adjustments, particularly under a government potentially focused on deregulation and tax cuts? - While seemingly minor year-to-year, consistent inflation indexing, especially when coupled with other potential tax cuts or deregulation efforts from the Trump administration, could gradually erode the tax base or at least constrain revenue growth. - This could put greater pressure on the government to seek alternative revenue sources or increase fiscal deficits, potentially impacting future public spending priorities or raising concerns about national debt sustainability. - For investors, this suggests that U.S. fiscal policy in the coming years may continue to lean towards stimulating the economy through tax reductions rather than increased spending, which could benefit corporate earnings but also pose long-term challenges for federal budget balance.