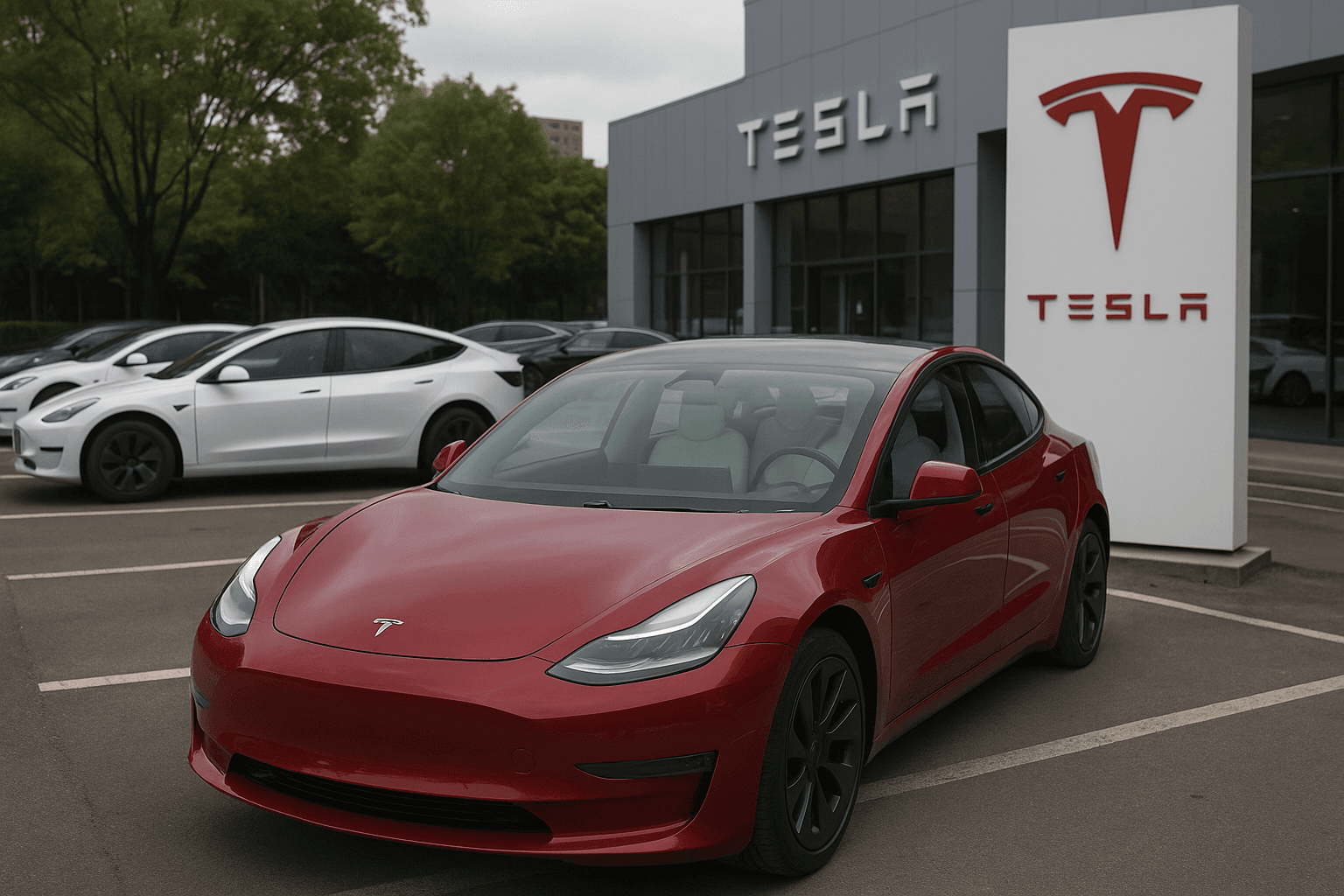

Tesla’s China sales surge signals shift in strategy as EV price war tightens

News Summary

Tesla’s Shanghai factory shipped 90,812 vehicles in September, a 2.8% year-on-year increase, reversing months of decline and signaling a strategic shift for the company in China's highly competitive EV market. The majority of these deliveries were to Chinese buyers, indicating growing domestic demand ahead of the Golden Week holiday. In contrast, China’s EV leader BYD reported its first year-on-year sales decline in over 18 months, with a 1.3% drop in Q3 deliveries. The Chinese government has urged automakers to curb excessive discounting and “unhealthy competition,” along with faster payments to suppliers, amid concerns that aggressive pricing could compromise vehicle quality. Tesla’s recent introduction of a six-seat Model Y suggests a pivot towards China’s fast-growing family buyer segment. The policy shift by Beijing could offer Tesla some breathing room, as the company has resisted major price cuts. However, with China’s economy slowing and consumer sentiment fragile, automakers may struggle to meet sales targets without incentives.

Background

China is the world's largest electric vehicle market, and its EV sector is undergoing an adjustment period after years of rapid expansion fueled by generous subsidies and innovation. The market, characterized by fierce price competition, is now confronting tighter regulation and slowing consumer demand. Beijing has explicitly voiced concerns over “unhealthy competition,” particularly excessive discounting, arguing it compresses industry margins and could lead to compromises in vehicle quality, potentially pushing smaller brands to the brink. Tesla’s Shanghai factory serves both the domestic Chinese market and functions as a critical global export hub, playing a vital role in meeting the company's worldwide delivery targets.

In-Depth AI Insights

What does Tesla's rebound amidst BYD's dip and Beijing's intervention reveal about the evolving competitive landscape in China's EV market? - Tesla's rebound likely reflects Beijing's policies to curb price wars, which could favor brands capable of competing on value and innovation rather than purely on price. - BYD's temporary decline might not be a long-term indicator of its competitiveness but rather a sign of adjustment within its vast product portfolio under current policy pressures, or a reflection of fluctuating demand in specific segments. - Tesla's introduction of the six-seat Model Y suggests a strategic pivot to capture emerging family buyer demand in China, a more sustainable strategy than pure price competition, especially as policy supports quality over aggressive pricing. How might Beijing's crackdown on “unhealthy competition” impact the long-term profitability and innovation dynamics for both foreign and domestic EV players in China? - The policy will likely stabilize industry margins, particularly for larger players, by removing pressure for unnecessary price cuts driven by intense competition. This could lead to more rational profitability but potentially dampen explosive market growth. - Limiting excessive discounting may challenge smaller or newer brands that rely heavily on price as a competitive lever, potentially leading to industry consolidation and pushing survivors toward technological and quality innovation. - Long-term, this encourages all players to shift focus from volume at all costs to investing in product quality, service, and differentiated technology, thus improving the overall health and international competitiveness of China's EV sector. What are the broader implications for Tesla's global strategy, given its reliance on the Shanghai plant and softening demand in other key markets? - China's market performance is critical for Tesla to meet its global delivery targets, especially with weakening demand in other major markets. Stable output from Shanghai is key to offsetting regional softness. - Tesla's targeted product strategies in China, such as the six-seat Model Y, could serve as a model for replication in other global markets, focusing on catering to specific consumer segments rather than universal price reductions to sustain growth and margins. - This indicates Tesla needs more agile regional market strategies to adapt to diverse regulatory environments and consumer preferences, reducing over-reliance on a single market or product line to enhance its global operational resilience.